10 Forgotten Additional Travel Costs - Tips for the Perfect Travel Expense Reporting

Additional travel expenses that are forgotten to be reported, that can also be reimbursed tax-wise.

Additional travel expenses that are forgotten to be reported, that can also be reimbursed tax-wise.

There are additional travel costs and expenses that are often incurred. Those expenses can be reimbursed, from a taxation perspective, if they haven't been already reimbursed by the employer. However, they are often not submitted with the travel expense report, because many travelers aren't aware that these costs are reimbursable.

When examining business trips, transportation and accommodation costs are usually the main focus. Smaller amounts, such as parking or toll fees are quite often forgotten about, despite the fact that they're reimbursable.

1. Travel expenses with a cab, train, plane, car or public transportation

2. Additional meal allowance domestically or abroad

3. Accommodation expenses domestically or abroad

For travel costs a distinction is made between the use of a company car and a private car. If a private car is used, then the expenses are calculated using the milage allowance. The commuter allowance is determined annually by the Federal Ministry of Finance. Read more about the current rates . Alternatively a detailed log can be kept in order to have all of the expense reimbursed.

The additional meal allowance depends on the duration and location of the stay (domestic or abroad trip), and the legally binding lump sums which are determined annually by the Federal Ministry of Finance. The Federal Ministry of Finance made a detailed table of 180 countries available , which covers the lump sums of additional meal allowances and accommodation costs. Check out our for the current flat rates.

The accommodation expenses are calculated per night and vary depending on the trip and whether or not it's domestic.The overnight flat rates require the employee to be absent from work for at least 24 hours. These per diems and flat rates are also adjusted annually and must be taken into account again in the travel expense report, in case it's created manually or even conventionally and on paper. you can read more on the flat rates for accommodation expenses.

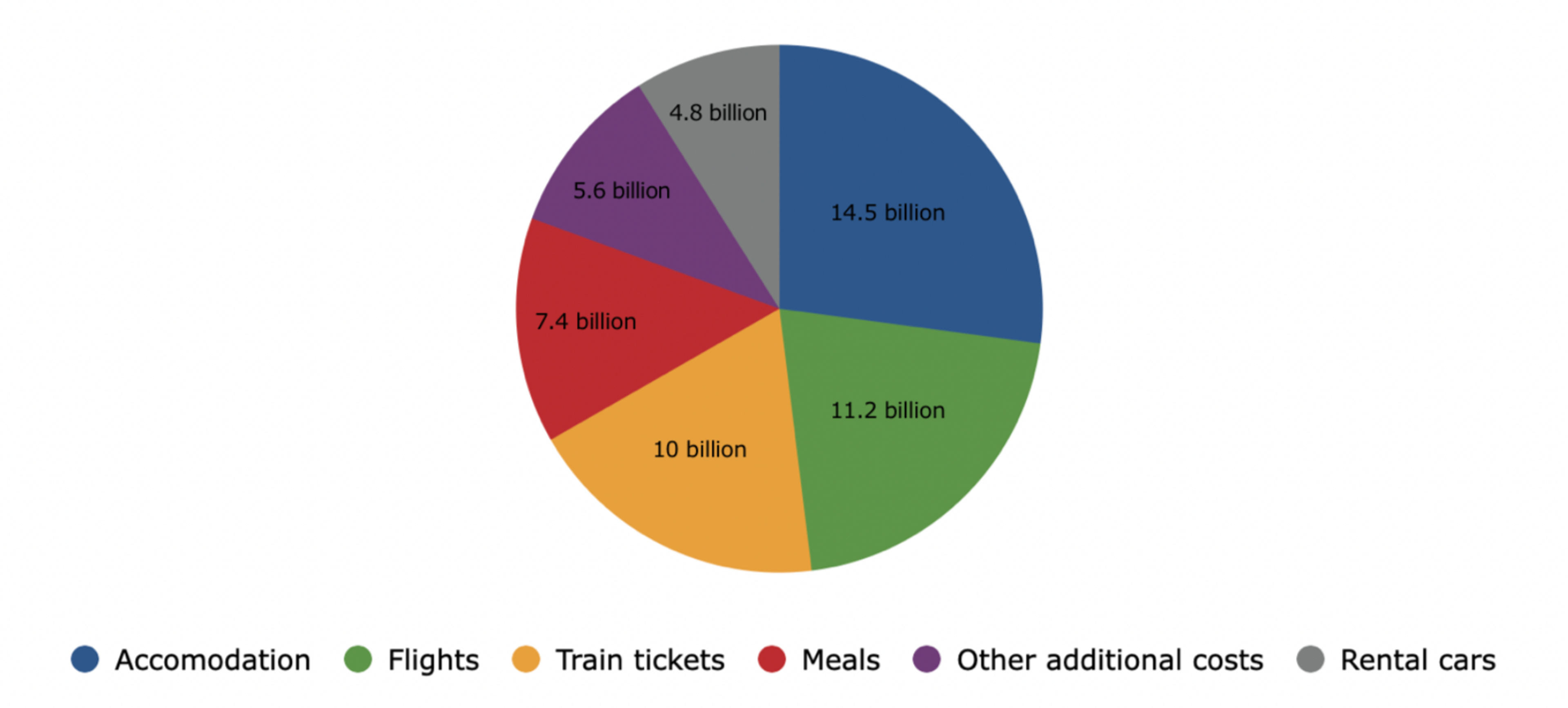

According to a business analysis by the German Business Travel Association (VDR, 2020), additional travel costs in 2018 in German companies account for a total of €5.6 billion, which is a considerable figure –a significantly higher number of unrecorded costs is possible, as they are often forgotten and not submitted with the travel expense report. For this reason, we’ve put together a list of the most common, reimbursable additional travel expenses for you.

1. Parking fees

2. Public transportation

3. Toll fees

4. Phone calls and internet

5. Privately owned cars

6. Tickets for any job-related seminars or workshops

7. Luggage storing fees

8. Luggage damage fees

9. Tips

Parking, public transportation, and toll fees are usually paid in cash and without receipts at the machine. Many submitters simply forget to include these costs in the travel expense report later. Therefore, make sure to always take the receipts with you.

Phone call and internet costs are usually private mobile phone contracts, which the submitter already has. Submitters do not think about including the portion of the private amount to be paid for professional use and submitting it with their travel expense report. Under certain circumstances, however, this effort can be worthwhile if the telephone and Internet were used to a particularly high degree -especially abroad. In this case, too, the expenses must be proven with receipt.

The use of privately owned cars for business trips is paid for by a legally defined mileage per diem. Many submitters are not sufficiently familiar with the legal requirements, and incorrectly (or sometimes not at all) state these costs. This leads to discrepancies in the settlement of accounts, which delays the process of reimbursement. As a responsible employer, you can deal with this by using suitable tools and providing your employees with sufficient information.

Tickets for seminars or workshops are sometimes purchased without a receipt, which can be reimbursed. You can create your own receipts and submit them as complete receipts.

Luggage storage and damage fees are two hidden expenses that travelers often forget about. All expenses that are luggage-related can be reimbursed, as long as you can prove the costs incurred by submitting a receipt.

Tips are usually paid in cash and without a receipt, which is why submitters forget to include it in their travel expense report. Therefore, the next time you go to a restaurant on a business trip, try to make sure that the tip is indicated on the receipt.

Receipts and vouchers remain the main component of every travel expense report and are necessary to be able to prove and reimburse the amounts incurred. If you lost or misplaced a receipt for additional travel expenses, this is not a problem. You can easily create a so-called "self receipt" for yourself. Here's how;

1. Purchase date

2. Purpose, assuming it's business-related

3. Name and address of the employee

4. Amount paid with the account information or credit card receipt

5. Issued date of the receipt

This will serve as a receipt and can be submitted with the travel report.

Keep track of every expense from the business trip in one file, keep all the receipts in one place and create your own receipts instead of the lost ones when necessary. This way, everything paid for in cash can be easily reimbursed with the travel expense report.

Circula is the ideal partner for your expense management. Circula's makes it easy to account for all employee expenses - per diems, cash expenses, travel expenses, and out-of-pocket expenses. The intelligent Circula adapts perfectly to your business processes and offers further premium benefits with attractive cashbacks. In addition, Circula offers companies tax-optimized such as the , a flexible and with which employees can be supported.

Automate your expense reporting and reimbursement with our award-winning app and a touch of artificial intelligence.

Start your free trial