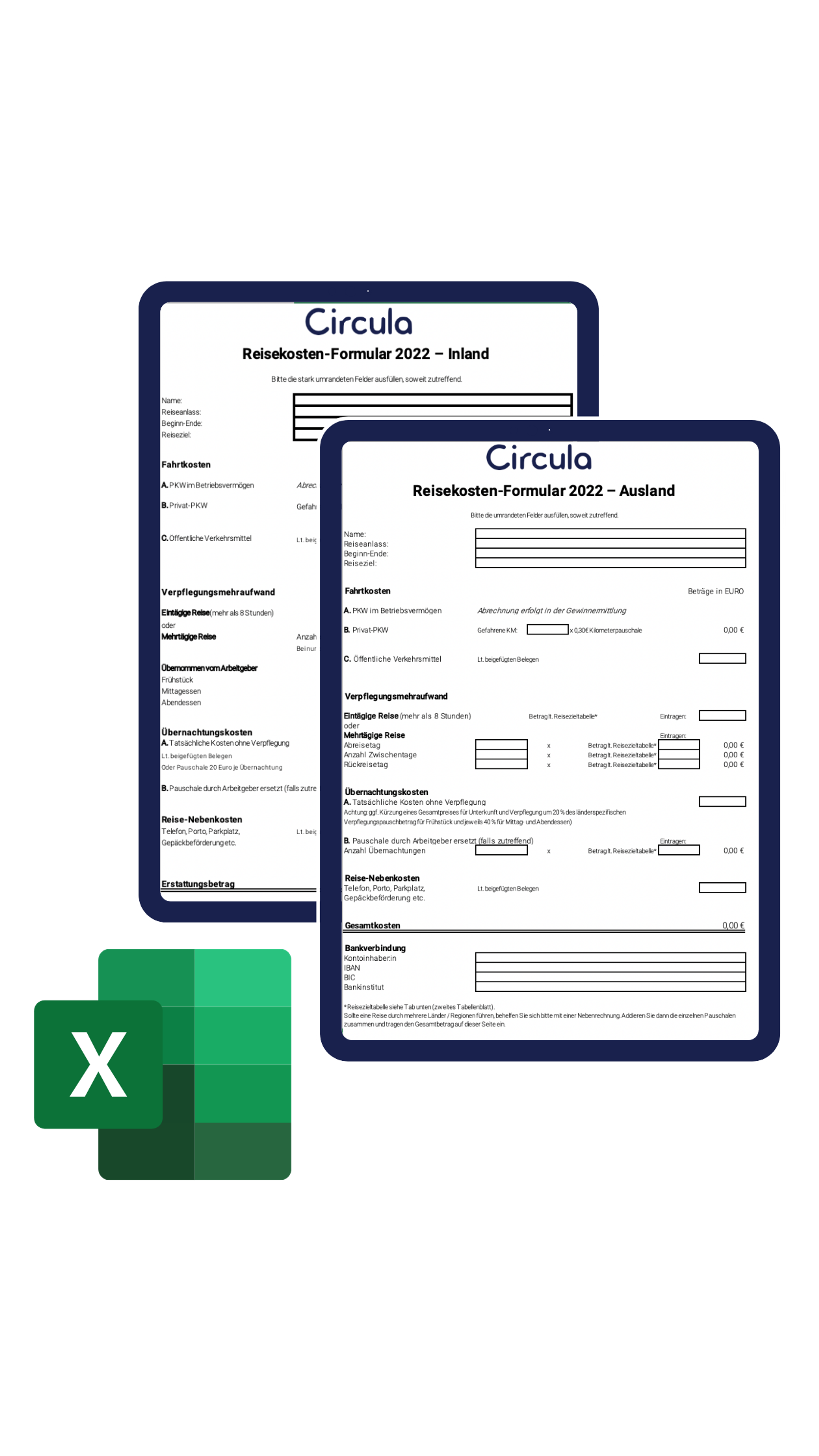

Travel expenses – Germany 2022

Get the free travel expense templates for 2022 here to download for free. The Excel files reflect the current rates for domestic and international travel.

Download Excel file

Travel expense form - template for download and alternatives

If you want to record travel expenses correctly, you have to pay attention to a few things. This is the only way to ensure that the costs are correctly accounted for in the company and that the tax office accepts the statement. A prepared travel expense form can save you a lot of work. We will show you what you should bear in mind and what other options are available.

What information should a travel expense template contain?

There are no set formal guidelines for travel expense reports. Theoretically, you can write your travel expenses by hand on a piece of paper. What is important is that the listing includes the following information:

- Name of the person who participated in the business trip.

- Employee number/staff number

- Duration of the business trip with date

- Listing of all expense items

- Destination of the trip

- Purpose of the trip

Since expense reimbursements within the company as well as tax deductibility via advertising expenses are only possible with the appropriate receipts, the travel expense template should ideally also include a column for the invoice number or receipt number. Ideally, the receipts are stapled directly to the travel expense report.

To facilitate allocation when posting expenses, the individual travel expense forms can be numbered. It is also possible to file according to the date of receipt.

What are the advantages of the travel expense form as an Excel document?

If you use a template for your travel expense report, you will benefit from various advantages:

- easy handling with common Office programs

- fast processing on PC or notebook possible

- Sending by mail possible

- simplified digital archiving

- Uniform arrangement of central data facilitates accounting

- simplified processing by the tax office

Travel expense forms are implemented as PDF, Word or Excel files. PDF templates are usually used as printouts, in which the data is entered manually. Word templates, on the other hand, can be easily customized by the user by adding additional rows or columns to the tables. Excel templates for travel expense reports have the advantage that the data can be processed more easily. For example, travel expenses from the Excel spreadsheets can be transferred to accounting programs or used for reporting to analyze expenses.

TIP: Travel expense form - when using templates from the Internet, look out for reputable providers.

The Internet is full of numerous free templates for accounting and likewise for travel expense reporting. However, many of these offers should be treated with caution. They may contain malware or spy on data. If you decide to download your travel expense form from Circula, you are relying on high quality and data security.

Disadvantages of travel expense forms

Travel expense forms have the great advantage that they can be filled out easily and quickly by employees. However, this supposed ease of use is offset by many disadvantages.

Reduced clarity: With an increasing number of travel expense reports, the accounting department in a company can quickly lose track of the forms if they are submitted in paper form or in differently formatted documents.

Increased administrative burden: Each travel expense form must be reviewed, usually printed out, and then archived in file folders. This costs a lot of time, which the accounting department can better use for more important tasks.

Insufficient compliance with GoB: Due to the lack of an overview, manually created travel expense templates can easily compromise the principles of proper accounting (GoB). This can result in incorrect postings, which, in addition to potential problems with the tax office, can also lead to internal miscalculations. As a result, budget planning becomes more difficult or "incorrect" costs are calculated for business trips.

More difficult digital archiving: If travel expense forms are printed out, digital archiving of the documents is time-consuming because they first have to be scanned again after posting and then saved. But even digitally submitted Word travel expense templates or Excel sheets do not always meet all the requirements for audit-proof archiving.

As you can see, the simple and flexible handling of travel expense templates is primarily confronted with objections of correct accounting. An equally simple and at the same time secure as well as clear solution for travel expense accounting is digital.

Optimize your travel expense report easily via app

With Circula, you can dispense with paper travel expense forms. Using the app, all relevant data can be digitally recorded during the business trip. Thus, the settlement of employees with your company is child's play. Likewise, the data can be used with little effort for the declaration of advertising costs in the tax return.

Further advantages: All requirements for the principles of proper accounting are met. Travel expenses can also be easily evaluated and analyzed. In addition, employees in the accounting department as well as your employees save a lot of time. Digital travel expense reporting can thus also reduce personnel costs.

Go digital beyond Excel

Discover now the true digital travel expense report – simple, mobile, compliant.